ICBC to OCBC Bank remittance fee

First of all, you have already got one.OCBCBank card number (if you don't haveOCBC Bank Card,Please refer to my tutorial on opening a bank card) Then the question is, how to transfer money to your OCBC bank (overseas bank) card?

Transfer from ICBC to OCBC:

1. I have practiced it myself, and what I show you is the process I have used, gone through and succeeded;

2. ICBC has the lowest handling fee, 40 yuan per transaction.

3. Other bank apps have similar operations and are basically the same.

ICBC to OCBC Bank remittancepremise

①, be prepared withOCBC Bank CardICBC card with the same name;

②, ID number;

③. The bank card holder must be present because facial recognition is required;

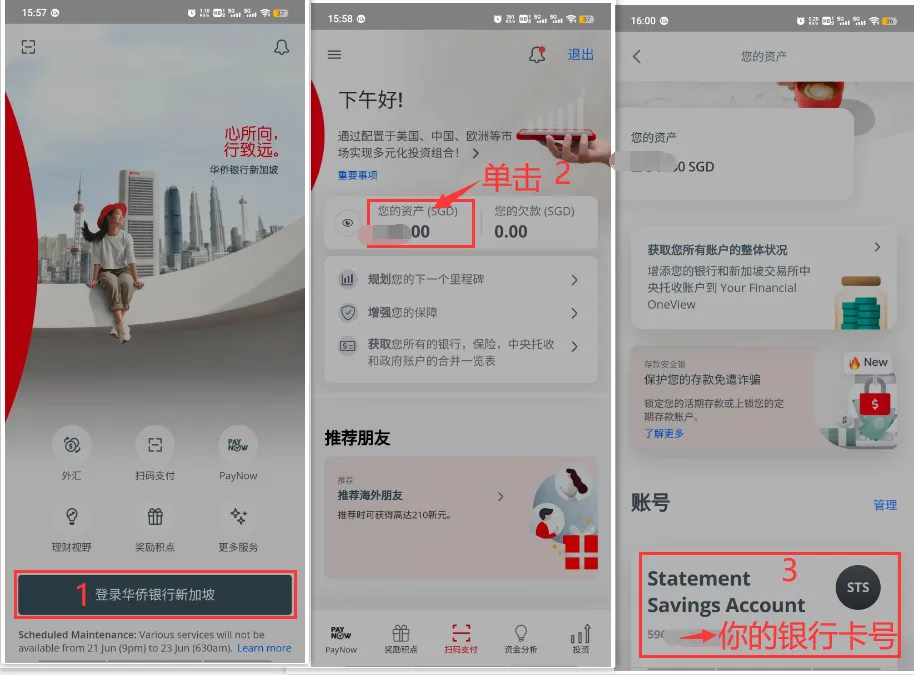

④、OCBC Bank CardInformation, how to find bank card information, the operation process is as follows

First record the OCBC SGD card number

Log in to your mobile phoneOCBCUse the bank app to check your Singapore dollar bank card number. Record your bank card number or write it down in a notebook, as it will be used in the following article.

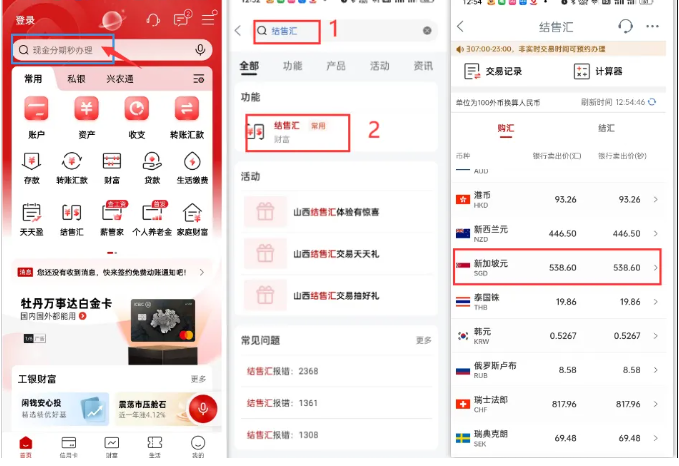

ICBC App Purchase Foreign Exchange

first step, log in to your ICBC app ==》Search for "Foreign Exchange Settlement and Sale" in the magnifying glass on the homepage ==》Select "Singapore Dollar", as shown below: When prompted whether to withdraw cash, select "No cash withdrawal required”.

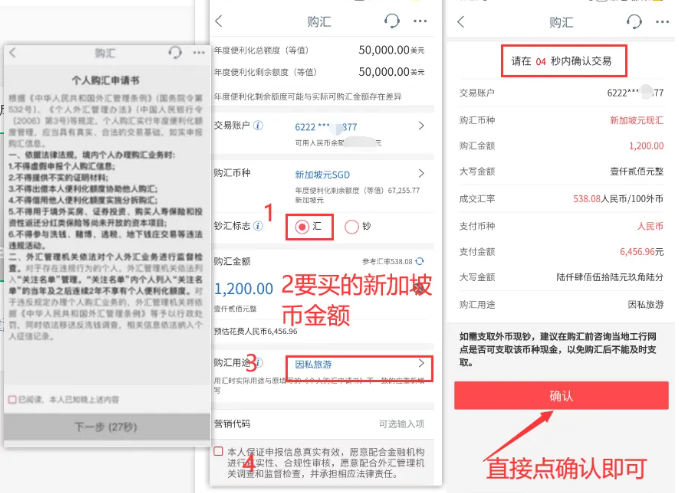

Step 2: Purchase foreign exchange. You will be reminded of the personal foreign exchange purchase application form for about 30 seconds. You must wait for seconds to read it, and then click "Next" ==》 Foreign exchange purchase interface ==》 Please confirm within 04 seconds ==》 Foreign exchange purchase is successful

If the above operation prompts "Do you want to withdraw cash?", select "No need to withdraw cash" as shown in the left picture below. The right picture 1 is a screenshot of successful foreign exchange purchase

ICBC cross-border remittance to OCBC

Log in to ICBC app ==》Homepage ==》Transfer and Remittance ==》Cross-border Remittance ==》Remittance to other banks abroad. See the first picture on the right below. There are two situations. Scroll down to explain the transaction snapshot remittance process and the first transfer process.

ICBC Transaction Snapshot Remittance

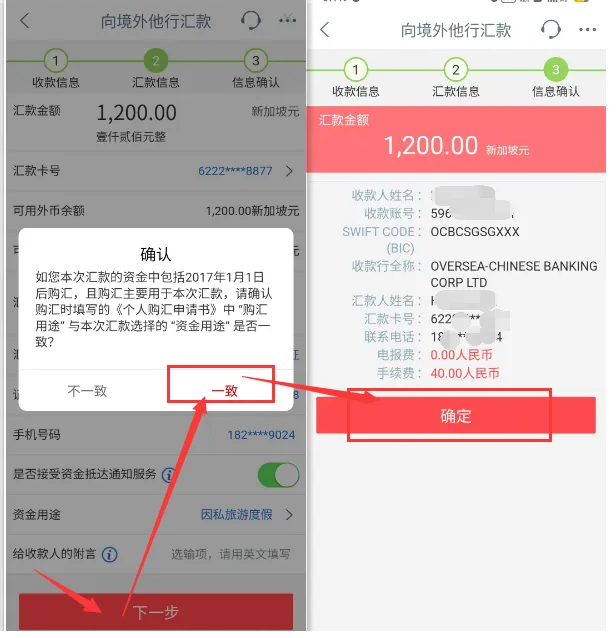

There is a transaction snapshot ==》Click the text in the line below the four words "Transaction Snapshot" (the information of the payee of your last remittance is listed) ==》Check the receipt information, if there is no problem, just click Next ==》This remittance information interface: ①Fill in the remittance amount; ②Supplement the ID card and phone number; ③When you click Next, there is a prompt box, select "Consistent" ==》Confirm the information, just click OK, the handling fee of 40 yuan is quite cost-effective.

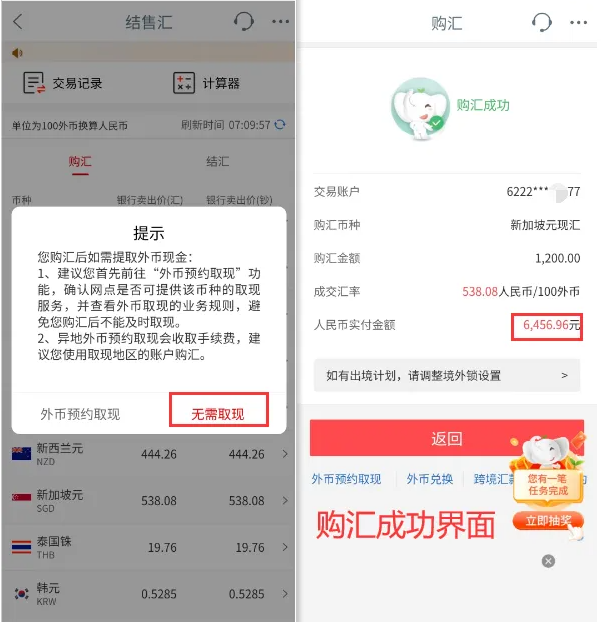

ICBC first transfer

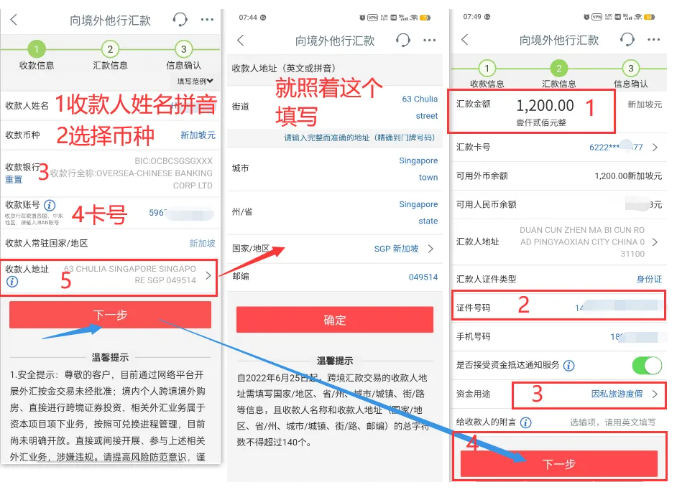

Payment informationThis step: ① Fill in the name of the payee, which must be in capital pinyin (it must be the same as the one you applied for the OCBC overseas bank card); ② Select the currency as Singapore dollar; ③ Fill in the receiving bank process: see the figure below for detailed operation procedures

Purpose of funds remitted to OCBC

Card number, fill in yourOCBCBank card number will do.

Payee address: This step took me 40 minutes to fill in (because I couldn't understand English addresses and had to break them down into street, city, state, country, and zip code). Today, you who are reading this tutorial are in luck. I will tell you the answer directly. You can type according to the picture or copy it from me:

Street: 63 Chulia Street

City: Singapore

State/Province: Singapore

Country: Click to search for "Singapore", then click to select "Singapore" and you will automatically return to the address filling interface;

Zip code: 049514

Remittance InformationThis step (pictured above, right 1) is relatively simple. Fill in the amount, ID number, and purpose of funds (selectPrivate travel) is enough.

When you click Next, you will be prompted whether the purpose is consistent. Select Consistent, and then it will jump to the third step: Confirm the information. Just click Confirm, as shown in the figure below.

ICBC to OCBC BankSummarize

① First go to the "Foreign Exchange Settlement and Sale" to buy foreign exchange (there is a limit of US$50,000 per year, which is enough for ordinary people), and then go to the cross-border remittance;

② Remember to use facial recognition in the last step of the transfer.

③After the first cross-border remittance is successful, when you remit money later, there will be a "transaction snapshot", and you don't need to fill in the receiving bank information again, which makes the operation more convenient. The operation process is as follows, a total of three steps.

④ Transfer 1,200 SGD from ICBC, and 1,192 SGD is received. Because the transit bank fee of 8 SGD is also deducted, the total cost is 40 RMB + 8SGD (42.86 RMB) = about 82.86 RMB.

ICBC to OCBC BankFAQ

Q: How long does it usually take for a cross-border remittance to arrive?

A: Usually 1-2 working days.

Q: Do I have to transfer 1,200 SGD for the first time? How much is appropriate for the first time?

A: If you transfer more than 1,000 SGD, you can getOCBC BankA 15 SGD promotion for new members. When you deposit more than 1,800 SGD into Changqiao Securities, you can enjoy lifetime commission-free. Considering the handling fee for cross-border transfers, the first transfer of more than 1,818 SGD is about 9,740 yuan, which can save you the time of waiting, because it takes 1-2 working days to arrive. Those with more spare money can consider how much to transfer.

How to get OCBC funds from Longbridge Securities

First, you need to open a Longbridge Securities account.Changqiao Securities Account Opening Tutorial

There also needs to be oneOCBC Account, after depositing money through this tutorial

Then throughOCBC deposits funds into LongBridge Securities