Common brokerage firms charging commissions in the U.S. stock market

In the U.S. stock trading market, investors often face a variety of brokerage options. However, not all brokerages offer commission-free trading services. The following are some common commission-charging brokerages in the market:

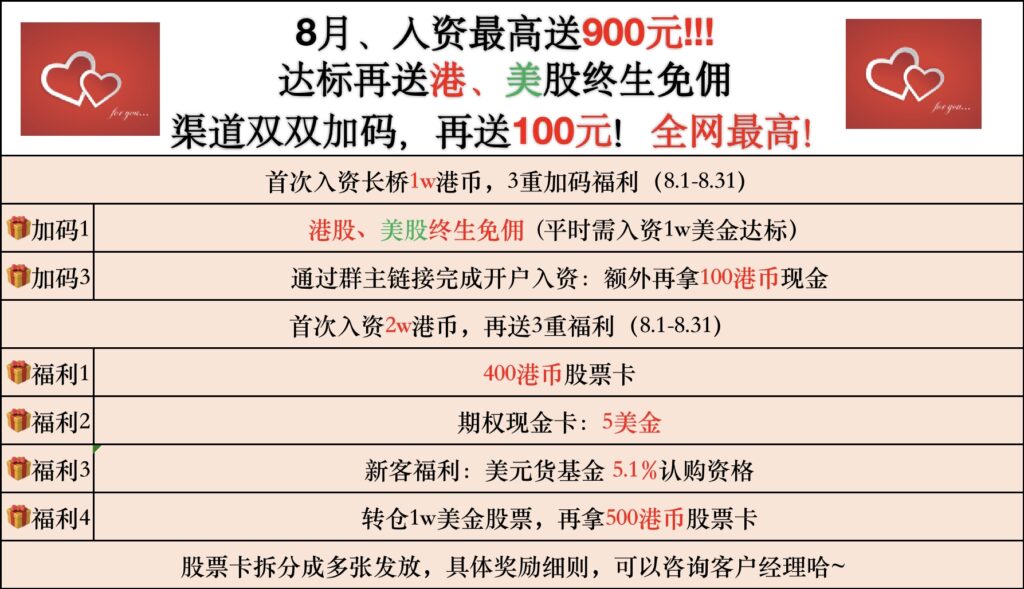

Long Bridge Securities: 0 commission, and register an account to receive benefits, clickReceive Longbridge Securities benefits first

- Futu Securities: As a well-known Internet brokerage, Futu Securities' US stock trading commissions are relatively high and may not be suitable for small investors.

- Tiger Brokers: Tiger Brokers is also a popular Internet brokerage, but its U.S. stock trading commissions are also expensive, especially for high-frequency traders.

- Snow Profit Securities: Snowing Securities also has high commissions for US stock trading, and there may be other additional fees.

- Traditional brokerage firms: Traditional brokerage firms such as JPMorgan Chase and Goldman Sachs usually charge higher commissions for U.S. stock trading, and their service processes may be more cumbersome.

The following picture is a comparison of the fees of major brokerage firms

LongBridge Securities is the leader in commission-free US stock trading

Compared with other brokerages, LongBridge Securities has a significant advantage in commission-free trading of US stocks. The following is a comparison between LongBridge Securities and other brokerages that do not offer commission-free trading:

- Commission Cost:Longbridge Securities completely waives the commission for US stock trading, and investors can complete transactions without paying any fees. In contrast, other securities that are not commission-free require investors to bear a certain percentage of commission costs.

- Transaction convenience:Longbridge Securities uses advanced Internet technology to make US stock trading very convenient. Investors only need to install Longbridge Securities' trading software on their mobile phones or computers to trade anytime and anywhere. Other securities that are not commission-free may have relatively cumbersome trading processes.

- Quality of Service:Longbridge Securities focuses on user experience and provides a wealth of investment tools and services, such as smart investment advisors and real-time quotes, to help investors better grasp market opportunities. Other securities that are not commission-free may have differences in service quality.

- Security:Changqiao Securities has adopted multiple security measures to ensure the safety of investors' funds, so that investors can trade with confidence. However, other securities that are not commission-free may have certain risks in terms of security.

- Rewards and Benefits:Click toReceive Longbridge Securities benefits first

Why choose LongBridge Securities for commission-free US stock trading?

Taking all the above factors into consideration, LongBridge Securities has a significant advantage in commission-free trading of US stocks. Here are some reasons to choose LongBridge Securities:

- Reduce costs:Commission-free tradingIt can significantly reduce investors' transaction costs and increase investment returns.

- Convenience:ChangBridge Securities' trading platform is easy to use, allowing investors to trade anytime and anywhere.

- Quality Service:Changqiao Securities provides a wealth of investment tools and services to help investors better seize market opportunities.

- Safety and security: Changqiao Securities has adopted multiple security measures to ensure the safety of investors' funds.

In short, for investors who want to trade U.S. stocks commission-free, LongBridge Securities is undoubtedly an option worth considering.

Account opening options ChangBridge Securities is a brokerage platform with lifetime commission-free,US stock account opening benefits Verify your mobile number to receive benefits